Understanding Accounts Payable AP With Examples and How to Record AP

June 15, 2023 2024-12-20 3:42Understanding Accounts Payable AP With Examples and How to Record AP

Understanding Accounts Payable AP With Examples and How to Record AP

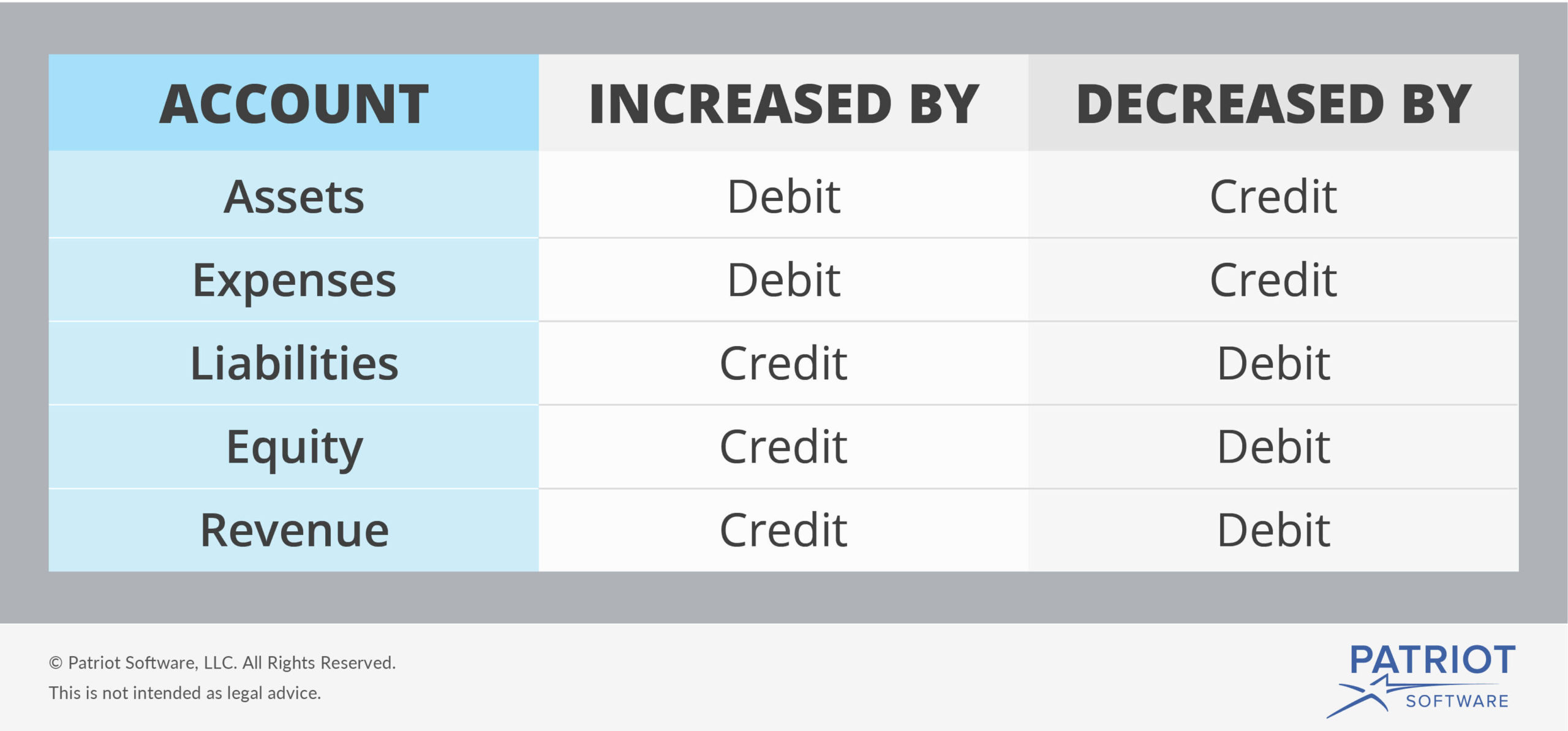

They are the backbone of a double-entry accounting system, which is a method used to keep financial records balanced and accurate. How journal entries are recorded depends on a clear understanding of debits and credits. Since accounts payable is a liability account, it is considered a credit account, where funds are credited after the purchase. However, money is debited from the accounts payable account when the vendor is repaid. Accounts payable (AP) refers to the obligations incurred by a company during its operations that remain due and must be paid in the short term.

How Precision Neuroscience streamlined systems and slashed data entry with Ramp

Accrued expenses are payments that a company is obligated to make in the future for goods and services that were already delivered. The next stage of the payables procedure is to enter the purchase day book details into the purchase ledger. The purchase ledger is a subsidiary ledger which is part of the double entry bookkeeping process. Debits increase your expense accounts because they represent money going out.

Receive the vendor invoices

It is because accounts payable usually represent short-term obligations that the company expects to pay within 12 months of the time it prepares its Balance Sheet. Accounts receivable are recorded as an asset in the balance sheet and are considered debit. However, when funds are received from the customer, they are marked against the account as a credit.

Double Entry Bookkeeping

- This process helps spot errors early, like missed transactions or duplicate entries and can prevent small discrepancies from turning into larger issues.

- For example, the suppliers would consider Walmart Inc to be a credible customer if it pays its suppliers within a decent credit period.

- If your supplier has determined that you are a credible customer, you may receive early payment discounts on your accounts payable.

- The formula is used to create the financial statements, and the formula must stay in balance.

- When looking at basic examples of accounts payable, you will often be referencing a purchase or vendor invoice.

This information can be helpful when making payment decisions and reviewing pricing. Building this AP report is straightforward if you already have a business expense tracker. Expense management software like Ramp is quick and easy to use and can help you easily build your history of payment report. Companies incur rent as an accrued expense because this is a cost that’s paid consistently and monthly. The company then writes a check to pay the bill so the accountant enters a $500 credit to the checking account and enters a debit for $500 in the accounts payable column.

Repeat the Process

Concrete guidelines are essential because of the value and volume of transactions during any period. Accounts Payable and Receivable are usually different departments in larger companies. However, smaller businesses may combine their accounts receivable and accounts payable into one department.

After receiving the material, the company discovers that some raw materials are of subpar quality. This material worth is returned to the vendor, and a journal entry is recorded. One employee may have one way of doing things, while another may do the same tasks differently. Implementing an automated accounts payable process is a simple yet effective way to get everyone on the AP team on the same page.

This approach not only aids in maximizing tax deductions, but also in ensuring overall financial and regulatory compliance. The management of accounts payable is an important financial function in businesses, large and small, and plays a pivotal role in cash flow management. Because how and when you pay your bills affects your cash flow — the lifeblood of your business. Assets and expense accounts are increased with a debit and decreased with a credit. Meanwhile, liabilities, revenue, and equity are decreased with debit and increased with credit. Debit always goes on the left side of your journal entry, and credit goes on the right.

This report serves as a reminder to use those credits and can even remind you to prioritize certain vendors to make use of your available credits. To ensure that everyone is on the same page, try writing down your accounting routine in a procedures manual and use it to train your staff or as a self-reference. Even if you decide to outsource bookkeeping, it’s important to discuss which practices work best for your business. This happens when you issue a refund, apply a discount, or adjust for an error because you’re taking from your total income. Debit pertains to the left side of an account, while credit refers to the right. The same rules apply to all asset, liability, and capital accounts.

The accounts payable (AP) department is responsible for implementing the entire accounts payable process. The department is also a key driver in supporting the organization as a whole when it comes to vendor payments, income tax features of c corporations approvals, and reconciliations. When you think of cash management, your first thought may be to increase collections from accounts receivable. Accounts payable, however, is another major factor in cash management.