Perpetual inventory system explanation, journal entries, example

March 22, 2024 2024-12-19 20:44Perpetual inventory system explanation, journal entries, example

Perpetual inventory system explanation, journal entries, example

This count and verification typically occur at the end ofthe annual accounting period, which is often on December 31 of theyear. The Merchandise Inventory account balance is reported on thebalance sheet while the Purchases account is reported on the IncomeStatement when using the periodic inventory method. The Cost ofGoods Sold is reported on the Income Statement under the perpetualinventory method. Moreover, the perpetual inventory system affects the income statement through its impact on the cost of goods sold. By maintaining up-to-date inventory records, businesses can accurately calculate the cost of goods sold, which directly influences gross profit and net income. This accuracy is advantageous in industries with fluctuating costs, as it ensures that financial statements reflect true economic conditions.

Is It Necessary to Take a Physical Inventory When Using the Perpetual Inventory System?

The perpetual inventory system is at a disadvantage if there isn’t an actual physical count to update the broken item’s data. For all sizes of e-commerce firms, a perpetual inventory system offers many benefits. It assists in eradicating labor costs and human mistakes in addition to helping in the real-time tracking of inventory data.

Perpetual Inventory Journal Entries

This is a major advantage, since any physical count requires a business to shut down its warehousing operations for the duration of the count. When a company sells products in a perpetual inventory system, the expense account increases and grows the cost of goods sold (COGS). This includes the materials and how to write a winning invoice letter in 8 easy steps labor costs but not distribution or sales expenses. With a perpetual system, inventory data is continuously updated, which helps reduce human errors that can occur during manual inventory counts. This improves the overall accuracy of your inventory records, which is essential for effective decision-making.

Elevate Your Inventory Management

- The COGS factors in those expenses such as overheads, warehouse, labour, and manufacturing costs that are directly related to the production of inventory stock.

- Under a periodic inventory system,Purchases will be updated, while Merchandise Inventory will remainunchanged until the company counts and verifies its inventorybalance.

- With a periodic inventory system, retailers calculate current inventory counts at the end of an accounting period or financial year and only then report on it.

- Book inventory refers to the amount of stock a business has on hand, according to accounting records.

Whenever a stock amount falls below this minimum, the system sends a notification suggesting you order more stock. Which of these two approaches is best depends mainly on the quantity of your inventory. The advantages of the perpetual inventory system outweigh the drawbacks for most organizations with extensive stocks. If you want to learn more about the details and uses of periodic inventory, head over to our guide on the periodic inventory system.

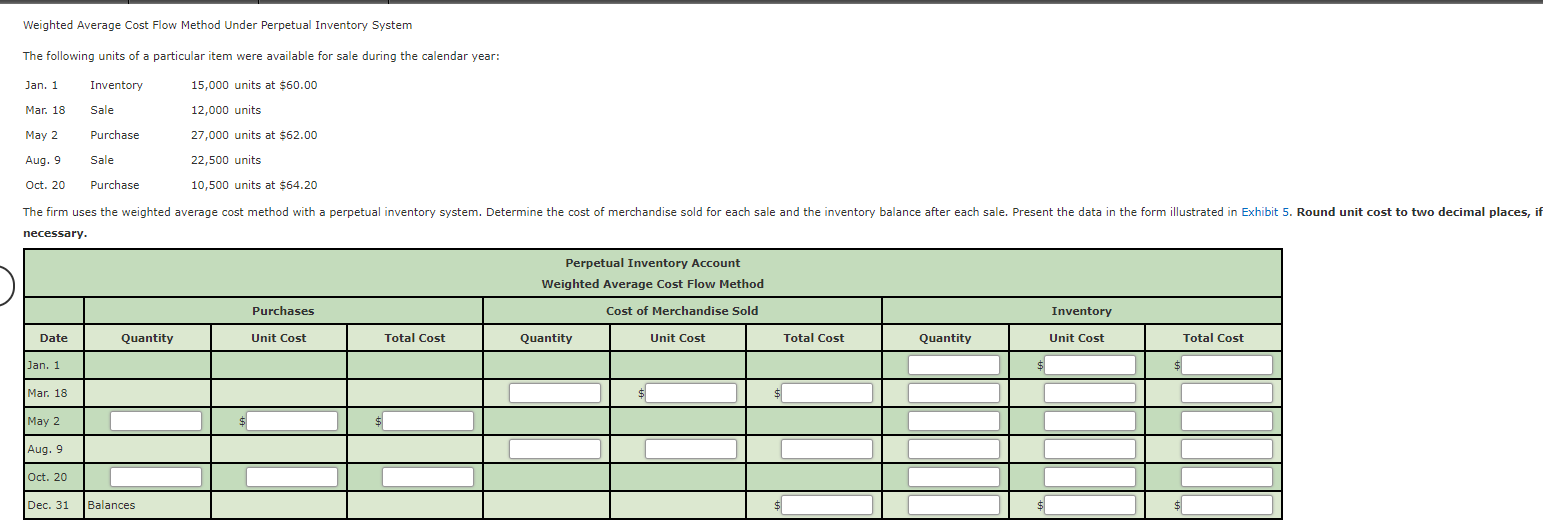

A perpetual inventory system would handle the large volume of inventory transactions and provide real-time stock availability updates. The weighted average cost method is the simplest to apply, plus you cannot manipulate income as easily as the other perpetual inventory methods. Sometimes accountants and stock controllers may need to adjust inventory levels using a manual journal entry. But, in general, accounting inventory is exactly the same, or almost the same, as the actual inventory. Perpetual or continuous inventory is an accounting practice that records inventory changes in real-time, without requiring periodic physical stock counts. Whenever goods are sold or received, the inventory level is adjusted accordingly.

Ask Any Financial Question

Perpetual and periodic inventory systems are two different valuation approaches that your business can use to track and monitor your inventory stock. Under a perpetual inventory system, inventory is updated continuously as the stock moves into and out of your business. The data from your perpetual inventory system can then be used to forecast sales trends and calculate reorder points. This method can reduce taxable income during inflation, as it matches recent higher costs against current revenues, resulting in a higher cost of goods sold and lower reported profits.

This section will explore the advantages and disadvantages of employing a perpetual inventory system for your business. This inventory management system provides a thorough view of inventory changes and allows for immediate tracking and reporting of the amount of inventory in stock. Want to learn more about the different types of accounts and how to properly journalize them? Head over to our guide on journalizing transactions, with definitions and examples for business. In a perpetual system, you could occasionally have to make an educated guess about how much ending inventory there was for a given period. It could be when creating financial statements or if the stock was destroyed.

When a transaction, such as a sale or a receipt, the product database is updated as part of a perpetual inventory system. As soon as a product is sold, the inventory management system integrated with the POS (point-of-sale) system debits the primary inventory across all sales channels. It would help if you were aware of the selling price, the purchasing price, and the affected accounts to record transactions in a perpetual system. When business owners or management need up-to-date information about inventory levels, then using a perpetual inventory system is the way to go. The journal entries used when bookkeeping in the perpetual inventory system are different compared to the ones used in a periodic system. A perpetual inventory system is a method of continuously accounting for the current state of an organization’s inventory.

FIFO means that the goods you purchased or manufactured first are the ones you sell first. This method tends to provide more accurate results when dealing with perishable goods or products with short shelf lives since they need to be sold before their expiration dates. To calculate inventory, you need to set up a system where every piece of inventory is entered into the system or deducted from it as it’s purchased or sold. Deskera ERP is a complete solution that allows you to manage suppliers and track supply chain activity in real-time.